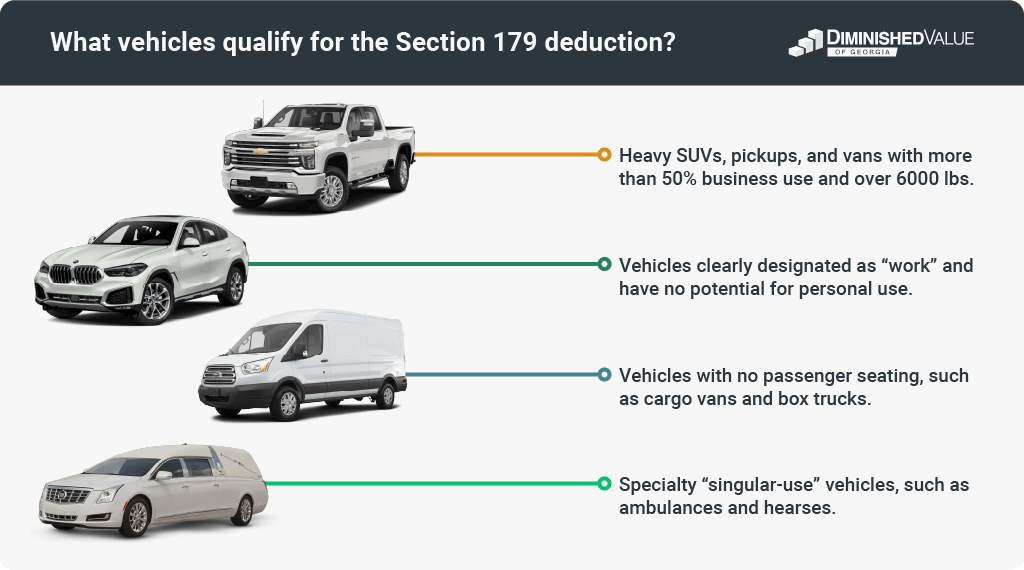

Section 179 List Of Vehicles 2024 – Section 179 has been referred to as the “SUV tax loophole” or “Hummer deduction” because it was often used to write off the purchase of qualifying vehicles. The positive impact of Section . For a work truck to qualify for the Section 179 deduction, it must be rated at more than 6,000 lb. gross vehicle weight rating. Trucks or vans commonly referred to as 3/4 ton qualify; half-ton .

Section 179 List Of Vehicles 2024

Source : diminishedvalueofgeorgia.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comSection 179 Eligible Vehicles at Bob Moore Auto Group

Source : www.bobmoore.comSection 179 Deduction – Section179.Org

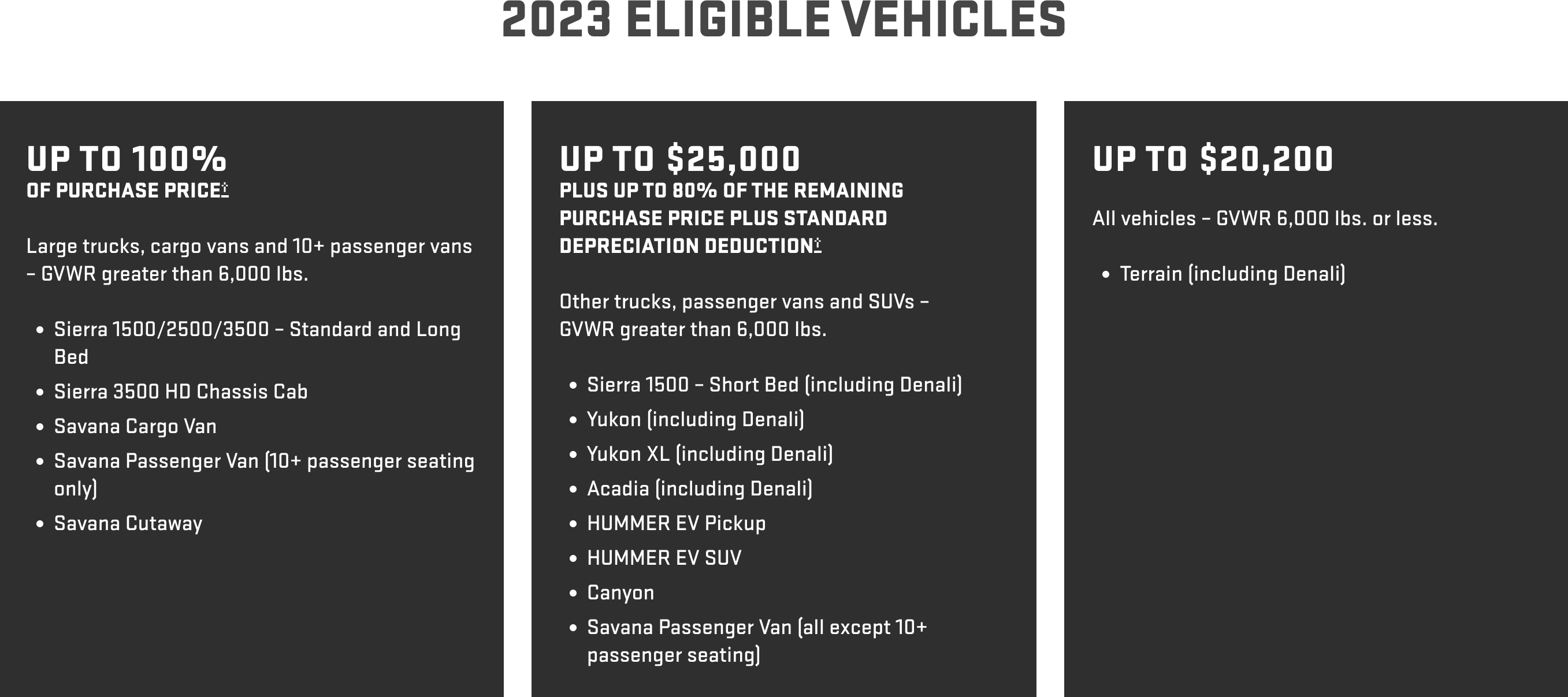

Source : www.section179.orgUnderstanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comDoes a ford raptor qualify for section 179.

Source : zkgxgx3525.convencionales.clSection 179 & Bonus Depreciation Saving w/ Business Tax Deductions

Source : www.commercialcreditgroup.comList of Vehicles Over 6000 lb that Qualify for the 2023 IRS

Source : www.taxfyle.comSection 179 Vehicles For 2024 Balboa Capital

Source : www.balboacapital.comSection 179 List Of Vehicles 2024 List of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in : In its annually updated Publication 946: How to Depreciate Property, the IRS provides a long list of items the maximum Section 179 deduction for sport utility vehicles is $28,900, again . Long ago, in 1958 Congress passed one of its many laws making “technical corrections” to the Internal Revenue Code. Mostly, these are truly technical corrections but there are times when .

]]>